Use this handy, humorous flow chart to find out if you’re financially ready for the new year!

Read MoreUse this comprehensive checklist to gather everything you may need to begin preparing your 2023 tax return, whether you’re filing on your own or with a tax professional.

Read MoreIn preparation for the end of the year, I have compiled a list of ideas to reduce your 2022 taxes and many of these must be taken care of before December 31st.

Read MoreEach stimulus payment has been slightly different, and you likely have questions, so here is some key information and answers to common questions about this one.

Read MoreHow to handle the new tax break depends on whether or not you already filed your 2020 tax return.

Read MoreYou may have heard that the IRS has a significant backlog going back as far as 2019 tax returns.

Read MoreThe actual amount of loan forgiveness will depend on the total amount spent over the 8-week period on several approved things.

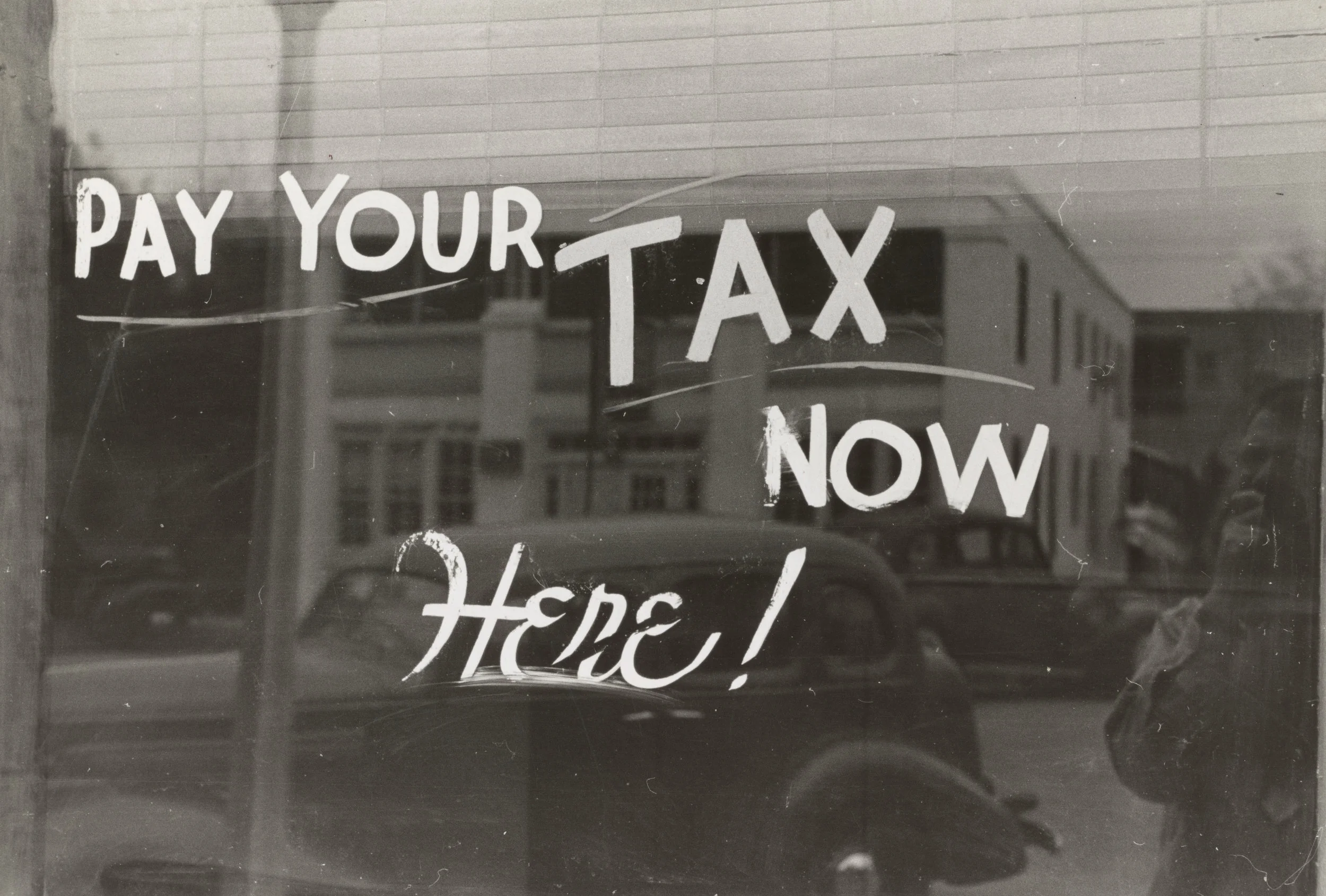

Read MoreIf you haven’t filed a tax return for several years, or you cannot afford to pay prior year taxes owed, then this post is for you.

Read MoreThe legality of gay marriage may have relieved some of the stigma surrounding homosexual couples, but complications around financial planning, budgeting, and tax filing remain prominent.

Read MoreBeing a parent or having dependents can make filing taxes a little more complicated, but it also provides some deductions and benefits that are worth exploring.

Read MoreAlthough there are benefits to both domestic partnerships and marriages, there are many differences when it comes to the law and its protections.

Read MoreIn a recent poll, more than one third of same-sex couples who married between 2013 and 2017 are confused about their tax-filing status.

Read MoreDue to concern over the Virginia state tax code status, I am writing to update you on your 2018 state return.

Read MoreIt’s unfortunate, but after natural disasters there is always an uptick in scams that affect disaster victims as well as individuals attempting to be generous and help out.

Read MoreTax payers need to have knowledge of three things: the current major scams that are in use, what the IRS actually does do/ask for and what the IRS does NOT do/ask for.

Read More